Western Forest Products, Inc. (WEF.TO)

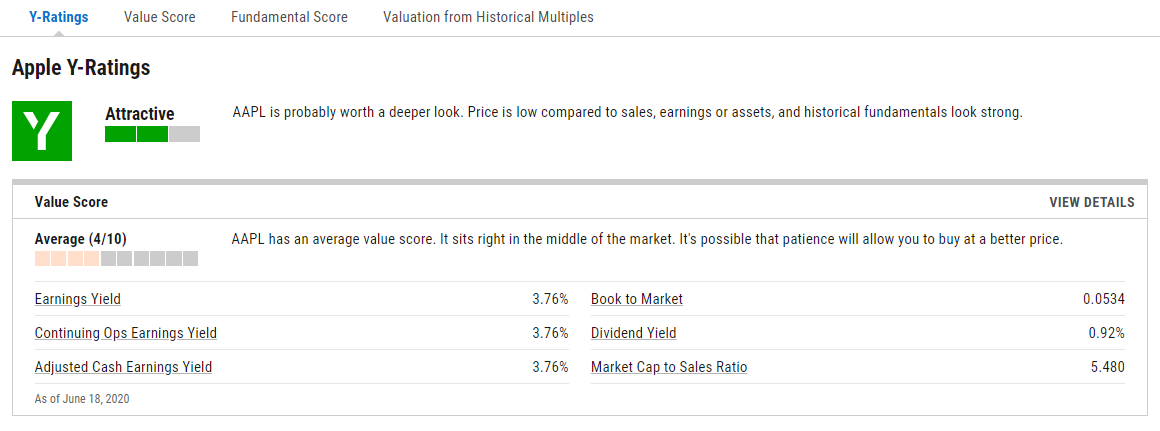

Y Ratings

We’ve taken the emotion out of equity analysis with our 100% quantitative stock rating methodology. The Y-Rating is based on three components – the Value Score, Fundamental Score, and Valuation from Historical Multiples. Through extensive testing and data analysis, we developed these ratings as a possible starting point for your research.

Value Score

Here we look at how a stock is currently valued compared to the rest of the market. The Value Score ranks each stock on a scale of 1 to 10 with 10 being the best. Based on backtesting results, the Value Score has been a very strong predictor of performance with higher scoring stocks consistently outperforming the market.

Fundamental Score

Different from the Value Score, the Fundamental Score is a series of pass/fail tests that help determine the financial health and stability of a company. This score is especially useful in surfacing red flags you may want to investigate prior to making an investment in a company. Historically, companies with a low Fundamental Score have, on average, severely underperformed the broad market.

Valuation from Historical Multiples

The most quantitative of the three Y-Rating Components, the Valuation from Historical Multiples uses past data to determine if a stock is under or over valued. The formula develops a “fair value” price that is then compared to the current price to determine the valuation percentage.

QUESTIONS?

- Email: support@ycharts.com

- Call: (866) 965-7552

READY TO GET STARTED?

Unlock My AccessAccess all financial metrics Now

Unlock access to all financial metrics by registering below. No credit card required.

Unlock My AccessQUESTIONS?

- Email: support@ycharts.com

- Call: (866) 965-7552