Banks Caught Between a Rock and a Digital Place in Their Transformation Journeys, Finds Genpact Research

Consumers want it all - Banks must deliver both technology convenience and personal touch to keep customers' trust and loyalty

NEW YORK, May 15, 2018 /PRNewswire/ -- Banks' huge investments in innovation may not yet be on the mark in creating experiences their customers want, according to new research from Genpact (NYSE: G), a global professional services firm focused on delivering digital transformation. The survey of more than 6,000 consumers in the United States, United Kingdom, and Australia shows that customers want both the convenience of new technology and the personal service they're used to with traditional channels – underscoring challenges that financial institutions face in achieving return on investment (ROI) from digital transformation initiatives.

Siri and Alexa can open new accounts but people still want personal touch

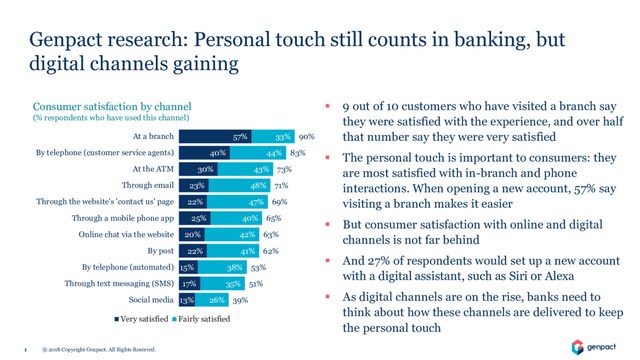

More than one in four consumers surveyed would be comfortable with a digital assistant such as Siri and Alexa (or a bank's own service) to open a new account for them, a clear sign of growing comfort with artificial intelligence as it becomes part of everyday lives. At the same time, more than half (57 percent) of respondents say face-to-face contact at the branch makes opening an account easier. Moreover, satisfaction levels with service representatives at branches and on the phone significantly outrank customers' experiences with mobile, webchat, text, and other digital channels.

"When it comes to achieving ROI from technology investments, banks are caught between a rock and a digital place," said Michael Menyhart, growth leader, Banking and Financial Services, Genpact. "Consumers want it all: the speed and convenience of new technology, and the human contact they get at the branch and on the phone. Loyalty is fleeting, and to encourage it, financial institutions must better understand what their customers want and need across all channels. Technology alone isn't the answer."

Trust in question, loyalty elusive, and fraud a key concern

Consumers expect and trust financial institutions to protect their data, and they would consider leaving their banks if that trust is broken. A fraud incident that is handled poorly by their financial institution is the top reason cited (at 55 percent) by respondents who would consider moving to another bank. Given that 36 percent of all consumers surveyed report being a fraud victim at least once, there is a sizable base potentially up for grabs to competitors. Even satisfied customers will not necessarily stay loyal. Other reasons for leaving banks are for better financial incentives (cited by 42 percent of consumers who would consider switching) and not having a quality digital service (31 percent).

Banks trusted more, but digital-only disruptors making inroads

Digital-only banks also are vying to take customers away. Generation Z and millennials (ages 18-34) are significantly more likely than baby boomers (aged 55 or more) to be willing to switch to a digital bank (cited by 40 percent of younger respondents vs. only 15 percent of older people surveyed). Still, all age groups polled trust traditional banks much more at fraud protection, with 74 percent expressing confidence in traditional banks vs. only 41 percent who say the same about fraud protection at digital banks. Traditional banks have the edge with institutional trust; the question is can they keep it?

Human contact preferred now, but for how long?

While the desire for human contact at banks still rules across all age groups, Generation Z and millennials express much higher satisfaction rates with digital channels than boomers. Younger customers are nearly five times more satisfied with mobile apps, and almost six times with text. In fact, even new channels like social media are making inroads, with 11 percent of younger respondents saying it is a preferred method to communicate with their banks. To stay competitive, financial institutions must heed the rising interest in digital channels, yet also remember to balance service with the personalized attention customers expect from the human side of banking.

To learn more about how consumers' trends are evolving, see Creating Winning Customer Experiences in Banking: How to mix digital and offline channels for competitive advantage.

Editor's Note

Siri is a registered trademark of Apple, Inc. Alexa is a registered trademark of Amazon Technologies, Inc.

About the Survey

Genpact worked with research firm YouGov to conduct an online survey in December 2017 of 6,287 consumers with a bank account from the United States (2,176), United Kingdom (2,029), and Australia (2,082). The study examined views of retail banking, with an emphasis on the digital channels and non-traditional banking trends. Just over one-quarter represent Generation Z and millennials (18-34 years old), 35 percent from Generation X (aged 35-54), and the remaining 40 percent are baby boomers (aged 55 or more).

About Genpact

Genpact (NYSE: G) is a global professional services firm that makes business transformation real. We drive digital-led innovation and digitally-enabled intelligent operations for our clients, guided by our experience running thousands of processes for hundreds of Global Fortune 500 companies. We think with design, dream in digital, and solve problems with data and analytics. We obsess over operations and focus on the details – all 78,000+ of us. From New York to New Delhi and more than 20 countries in between, Genpact has the end-to-end expertise to connect every dot, reimagine every process, and reinvent companies' ways of working. We know that rethinking each step from start to finish will create better business outcomes. Whatever it is, we'll be there with you – putting data and digital to work to create bold, lasting results – because transformation happens here. Get to know us at Genpact.com and on LinkedIn, Twitter, YouTube, and Facebook.

For more information:

Danielle D'Angelo (Genpact Media Relations) +1 914-336-7951 |

Abby Trexler (for Genpact U.S.) +1 212-931-6179 |

Laura Brooks (for Genpact U.K.) +44 207 680 7113 |

Rudra Bose (for Genpact India) +91 9811626585 |

![]() View original content with multimedia:http://www.prnewswire.com/news-releases/banks-caught-between-a-rock-and-a-digital-place-in-their-transformation-journeys-finds-genpact-research-300648396.html

View original content with multimedia:http://www.prnewswire.com/news-releases/banks-caught-between-a-rock-and-a-digital-place-in-their-transformation-journeys-finds-genpact-research-300648396.html

SOURCE Genpact