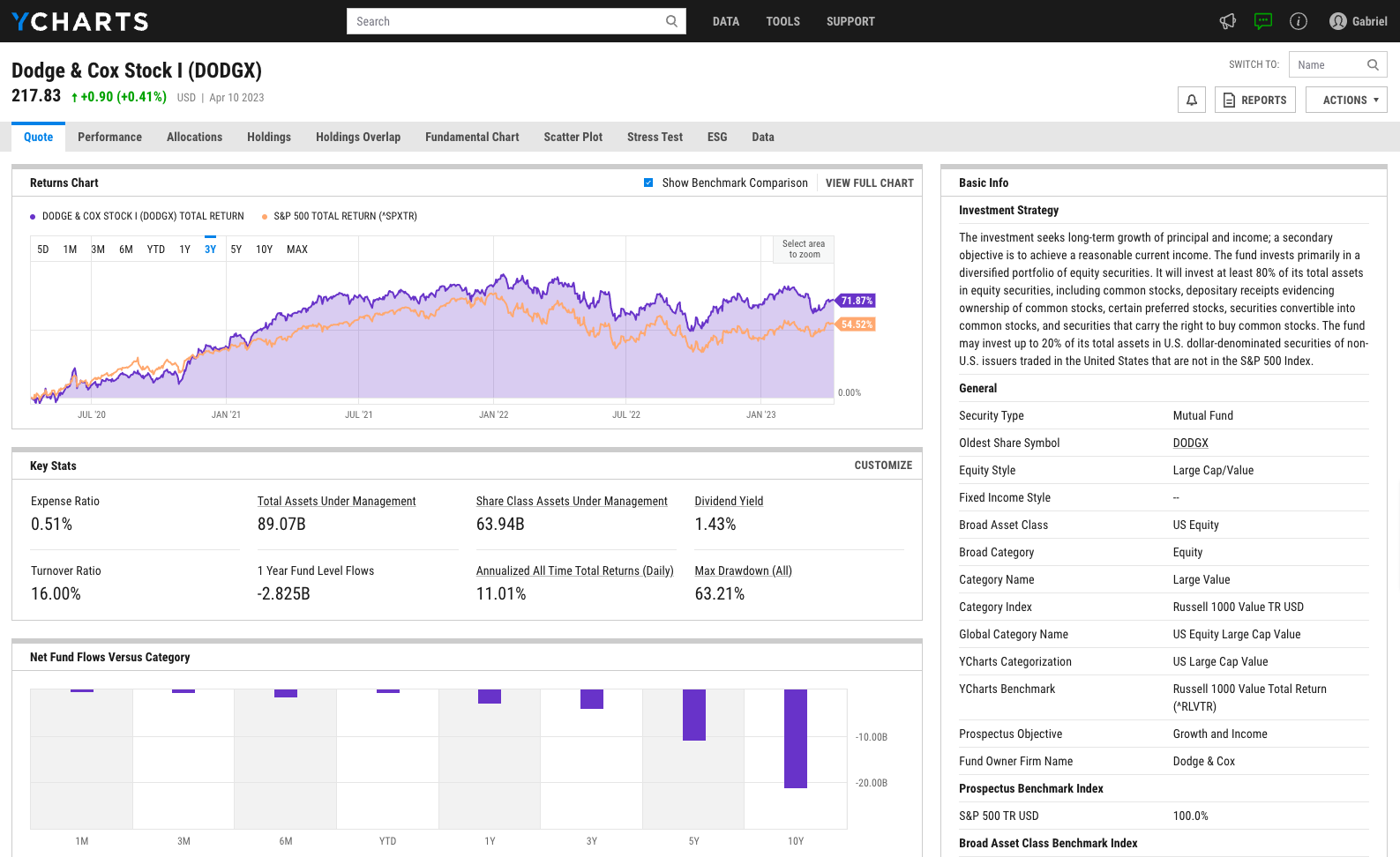

Mutual Funds

A universe of 45,000+ funds, plus CEFs and UITs, including asset flows, manager info, brokerage availability, category rankings, and more.

QUESTIONS?

- Email: support@ycharts.com

- Call: (866) 965-7552

READY TO GET STARTED?

Unlock My AccessAccess US Mutual Fund Data Now

Unlock access to US Mutual Fund Data by registering below. No credit card required.

Unlock My AccessQUESTIONS?

- Email: support@ycharts.com

- Call: (866) 965-7552