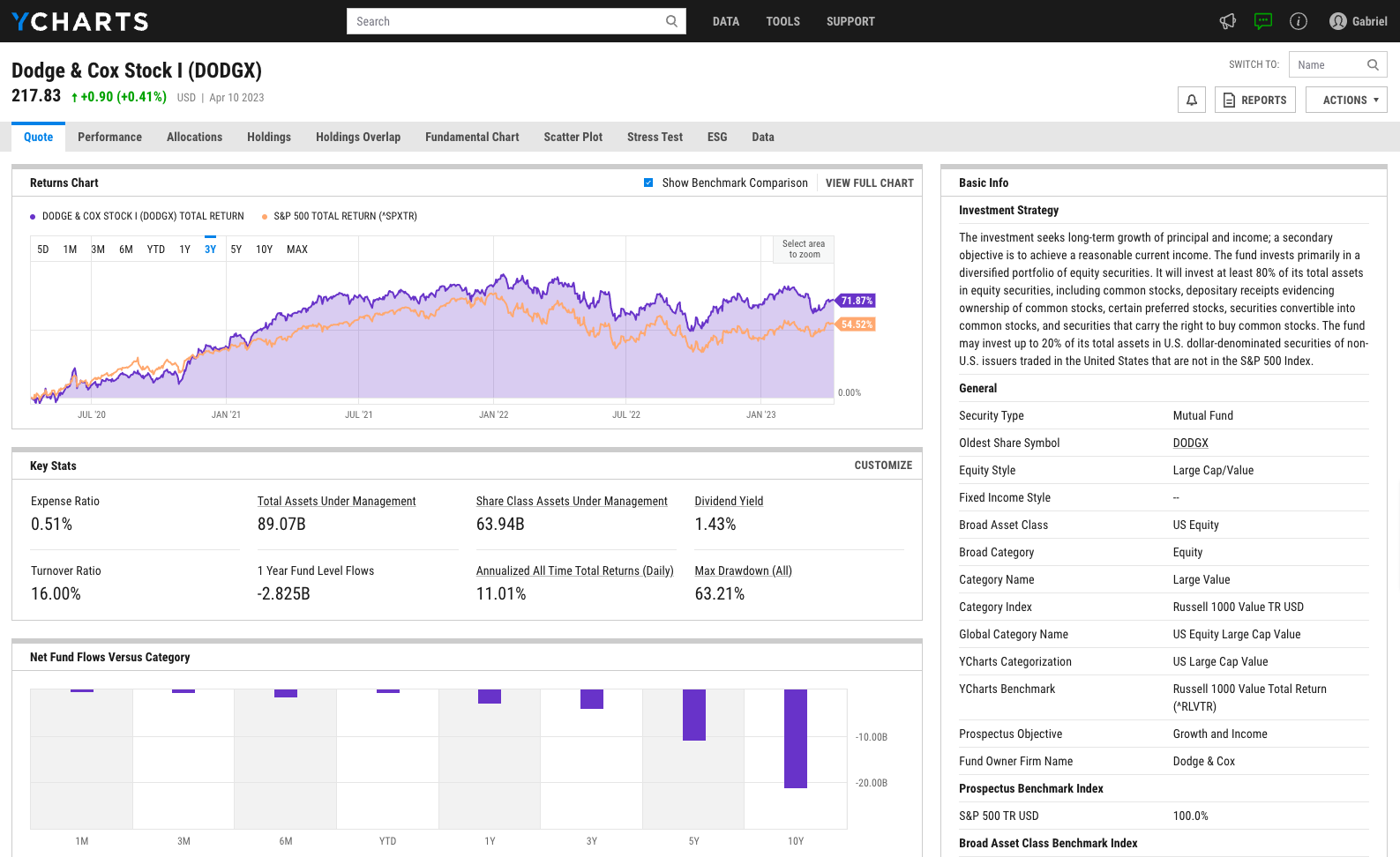

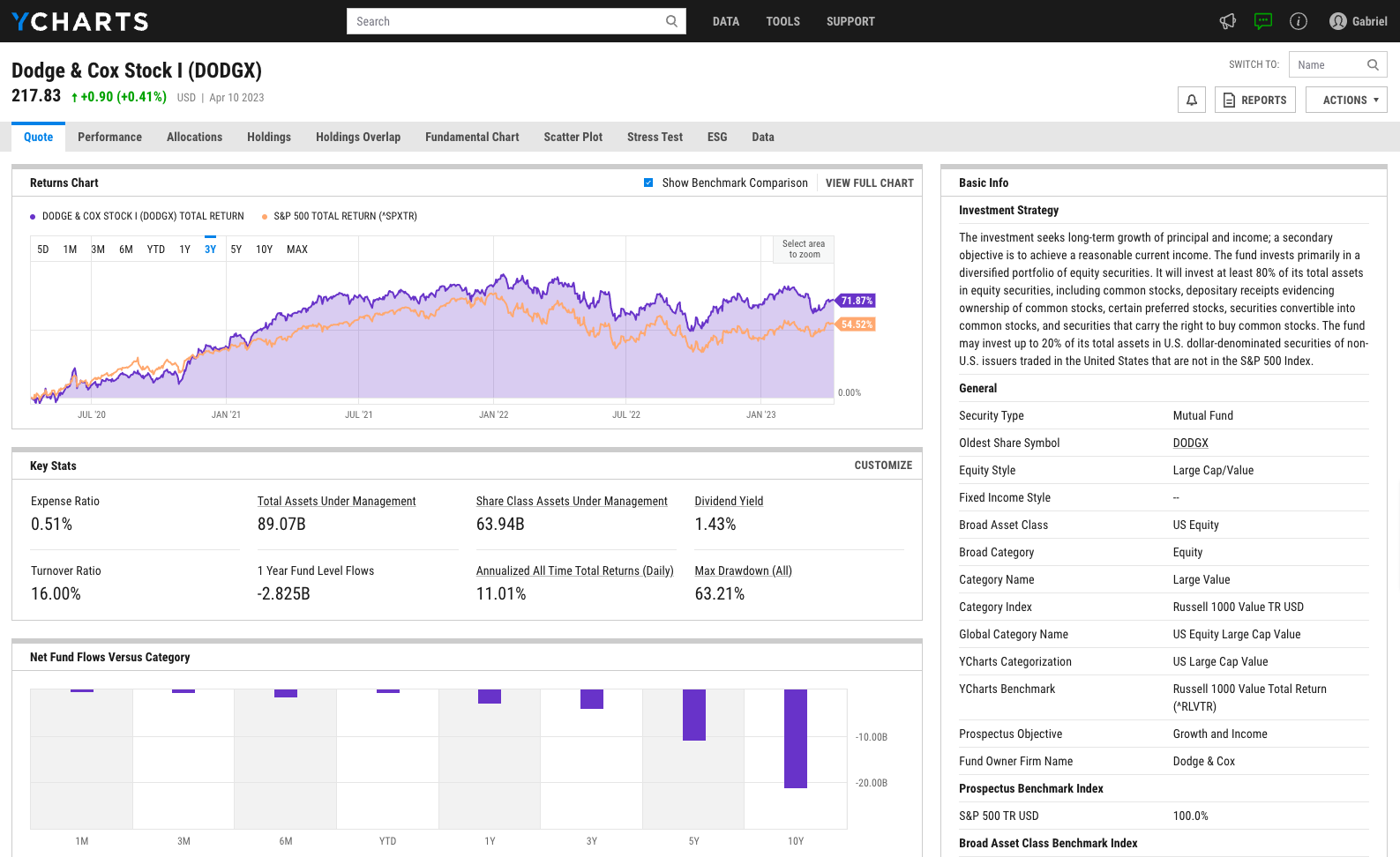

Mutual Funds

A universe of 45,000+ funds, plus CEFs and UITs, including asset flows, manager info, brokerage availability, category rankings, and more.

A universe of 45,000+ funds, plus CEFs and UITs, including asset flows, manager info, brokerage availability, category rankings, and more.