iMGP DBi Hedge Strategy ETF (DBEH)

Allocations

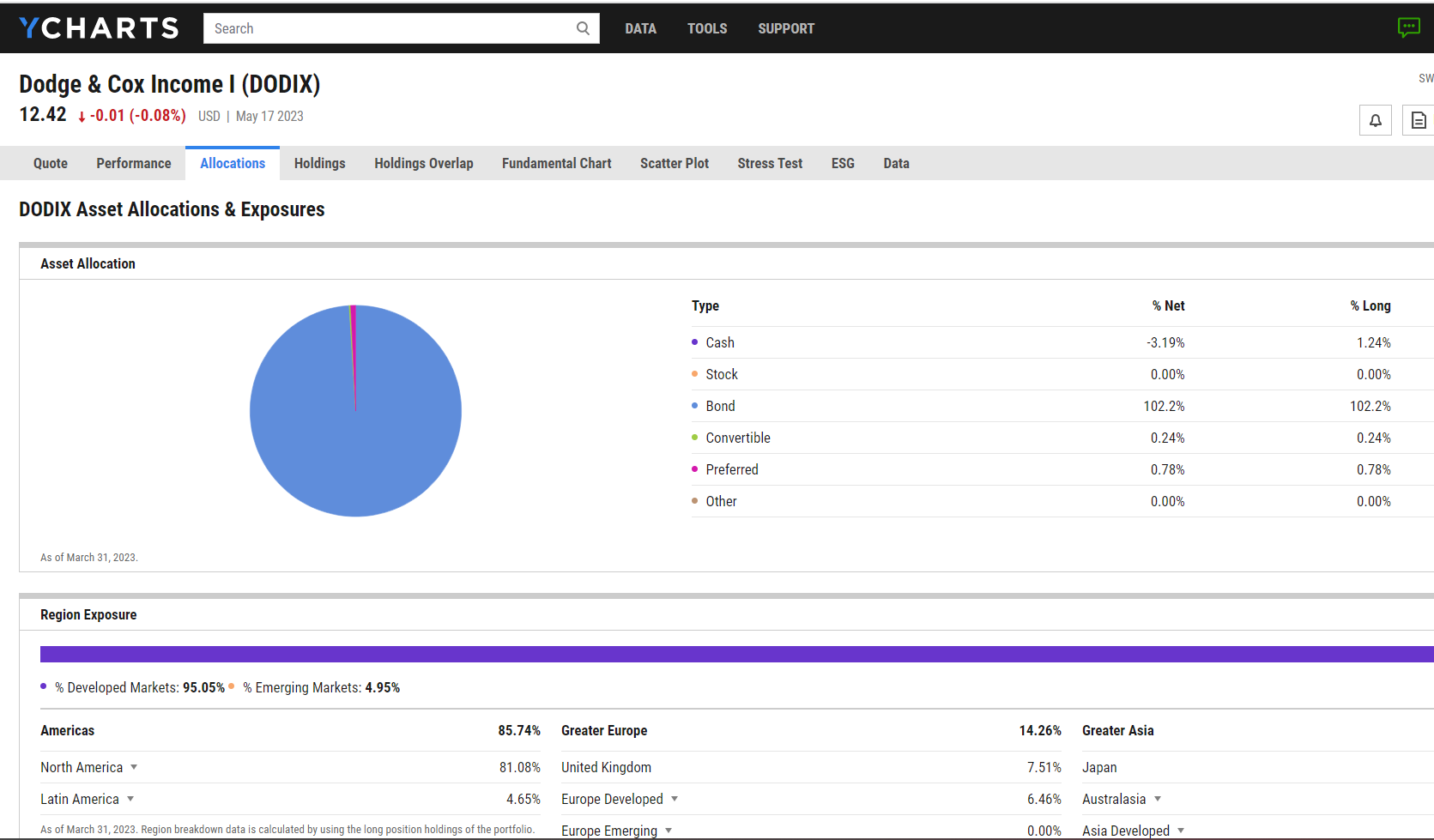

Navigate the intricacies of your investments with Allocation Data. Uncover investment styles, bond information, and regional exposure for ETFs, Mutual Funds, and portfolios.

Uncover Comprehensive Allocation Details

Delve into the intricacies of an ETF, mutual fund, or portfolio with Allocation Data. Access detailed insights into various asset types comprising funds or portfolios, enriching your understanding of a specific investment structure.

Gain Insight into Investment Style and Sector Distribution

Unravel the nuances of a fund’s investment style and the sectors dominating a fund or your own portfolio. This data empowers you to effectively align your holdings with your investment strategy and risk tolerance.

Examine Bond Maturity, Quality, and Geographic Region

Beyond equities, understand your exposure to different bond maturities and their quality. Plus, explore your holdings' geographic distribution, letting you gauge your exposure to various regional markets.

QUESTIONS?

- Email: support@ycharts.com

- Call: (866) 965-7552

READY TO GET STARTED?

Unlock My AccessAccess Allocations Now

Unlock access to Allocations by registering below. No credit card required.

Unlock My AccessQUESTIONS?

- Email: support@ycharts.com

- Call: (866) 965-7552